- Abstract(ed)

- Posts

- $BANANA: Yay or Na?

$BANANA: Yay or Na?

Insights and Predictions on the $BANANA token launch

$BANANA: Yay or Na?

This edition of Farming Alpha is Sponsored by QuantCheck Labs, a research institution that designs proprietary trading models to give cryptocurrency traders an edge! Discover how you can get ahead of the bulk of traders here!

GM/GE/GN to my indefatigable crypto savants! Last week I dropped the TG bot newsletter, packed full of insights and predictions. I also dropped a thread saying that $UNIBOT is up-only.

💰 7100 ETH Fees collected in a little over 3 months

👀 >$4m in Revenue distributed to holders

📈 $267m+ in volume

📊 $163m token mcap

🚀 9th in top 10 dapps by fees on-chain over the past 30 days

⬆️ 13k+ cumulative users

Here is a 🧵 on why $UNIBOT is 🆙ONLY 🔥🔥🔥

0/17 htt

— Hrojan Torse (@hrojantorse)

9:59 AM • Aug 30, 2023

Since that thread, $UNIBOT is down 40%. I guess I have to take that ‘L’ on my chest. The fundamentals have not deteriorated since that piece, but the speculation around the 3rd largest TG bot in the market launching a token might have something to do with the drastic price correction.

BANANA Gun bot is soon to launch a revenue sharing token, similar to $UNIBOT. In my previous newsletter, I referred to this one as a Blue chip, alongside $UNIBOT and Maestro.

In this newsletter, I am going to try to look into the future and see if $BANANA moons, or slips on its own peel. There also seems to be some saltiness in the offing, with $UNIBOT accusing the $BANANA team of being copycats (wonder how Maestro feels kek).

Let’s get into it!

Make sure to follow me on twitter for more on-chain ALPHA.

How is Bananagun Bot different?

Most sniper bots offer the same functionality, more or less. Some are better than others at the ease of bribing/speed. At its core, they offer you the ability to make profit on DEX trades by cycling in and out of trades really fast, MEV protection and honeypot resistance. In exchange for their services, they charge a % of all buys and sells (volume) on the platform. Variations are often slight/moderate.

$BANANA gun has barely been 3 months in the market, but has done fairly well to establish itself as the number 3 TG bot. They have managed to do so by finding a niche for themselves and differentiating in the following way.

Cheaper Fees

The easiest way to differentiate is to attack on fees. For folks trading millions, every basis point counts. While $UNIBOT and Maestro charge 1% of every buy and sell, $BANANA charges 0.85% (now 1%) on autosniping and 0.5% on manual buys and sells. This is 50% cheaper per trade than the larger incumbents.

Easier Snipe UX

For unlaunched tokens, Banana offers the ease of tipping in ETH instead of having to calculate the corresponding ETH amount in GWEI. P.S: whatever your input amount, that is the entire amount that will be used to bribe the block builders and “skip the queue”.

For tokens with MEV safeguards, you can use the deadblock functionality. Think of it as a backup tip to builders of the first block after the deablocks!

Built in MEV Protection

All tx’s are MEV protected. Unlike $UNIBOT and Maestro, which require you to enable the MEV protection function.

No Copy Trading and Limit Orders

You cannot use copy trading yet as it has not been launched. Similarly, you cannot use Banana for Limit orders as this functionality is in testing.

🍌 🔫 by the Numbers

Barely a week ago, these were the numbers that I posted.

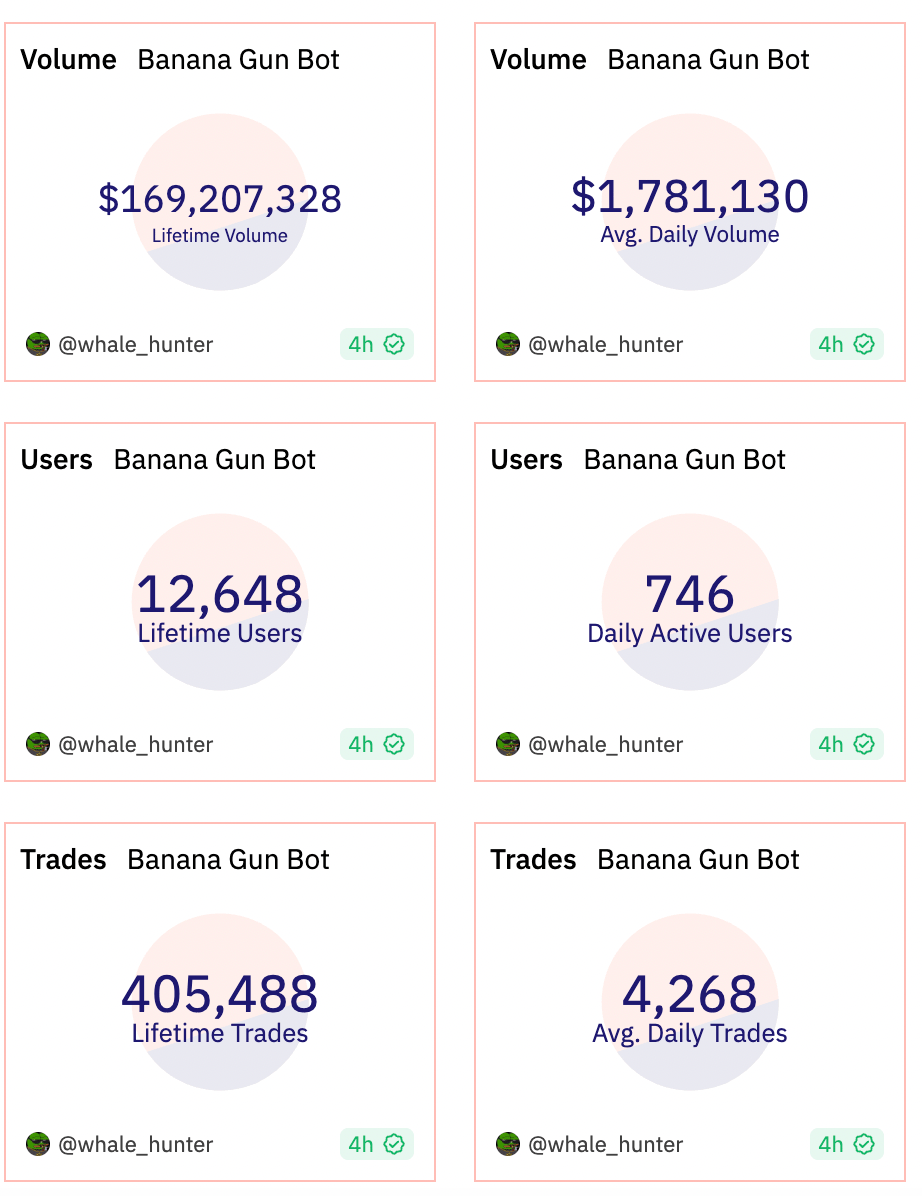

Lifetime Volume= $126.5m vs $169m now (35% growth in 7 days)

Avg Daily Volume= $1.48m vs $1.78m now (20% growth in 7 days)

Lifetime Users= 9256 vs 12648 now (37% growth in 7 days)

DAU= 600 vs 746 (25% growth in 7 days)

Lifetime Trades= 300k vs 405k (35% growth in 7 days)

Avg Daily Trades= 3537 vs 4268 (21% growth in 7 days)

Banana Gun v/s UNIBOT 🍌 🔫 v 🦄 🤖

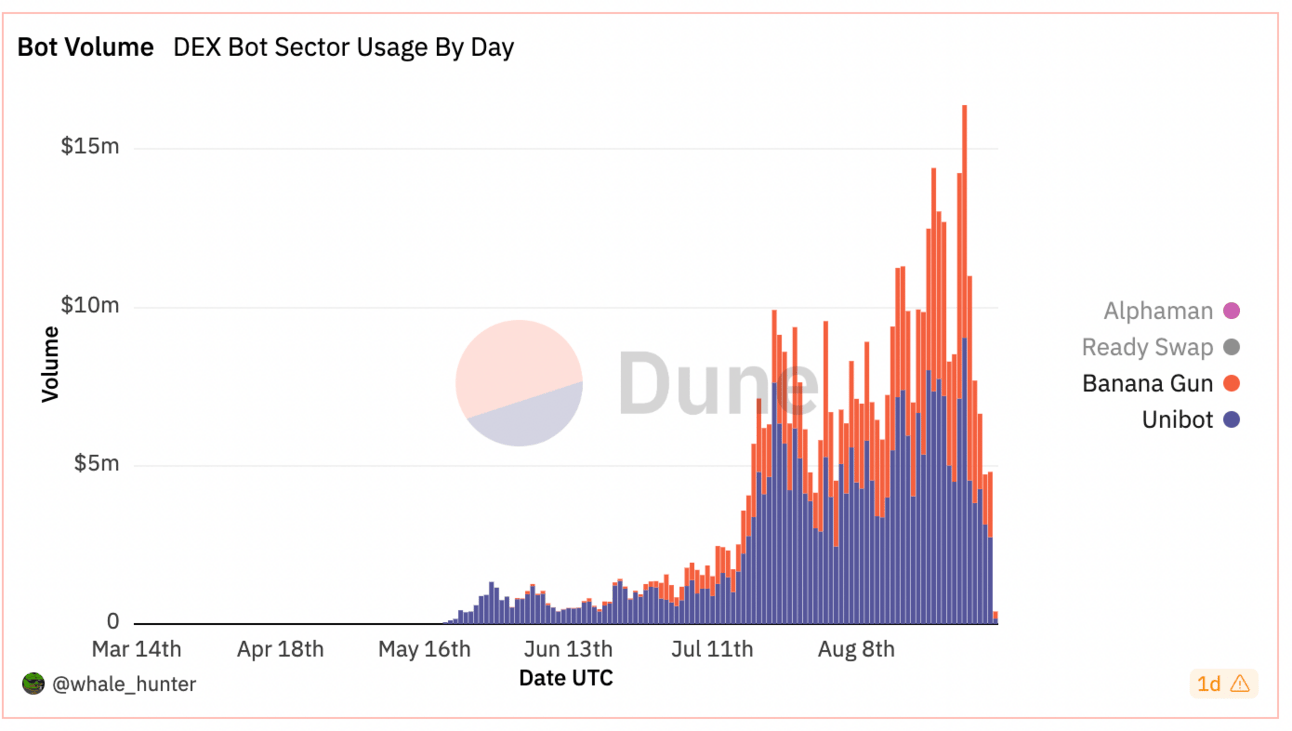

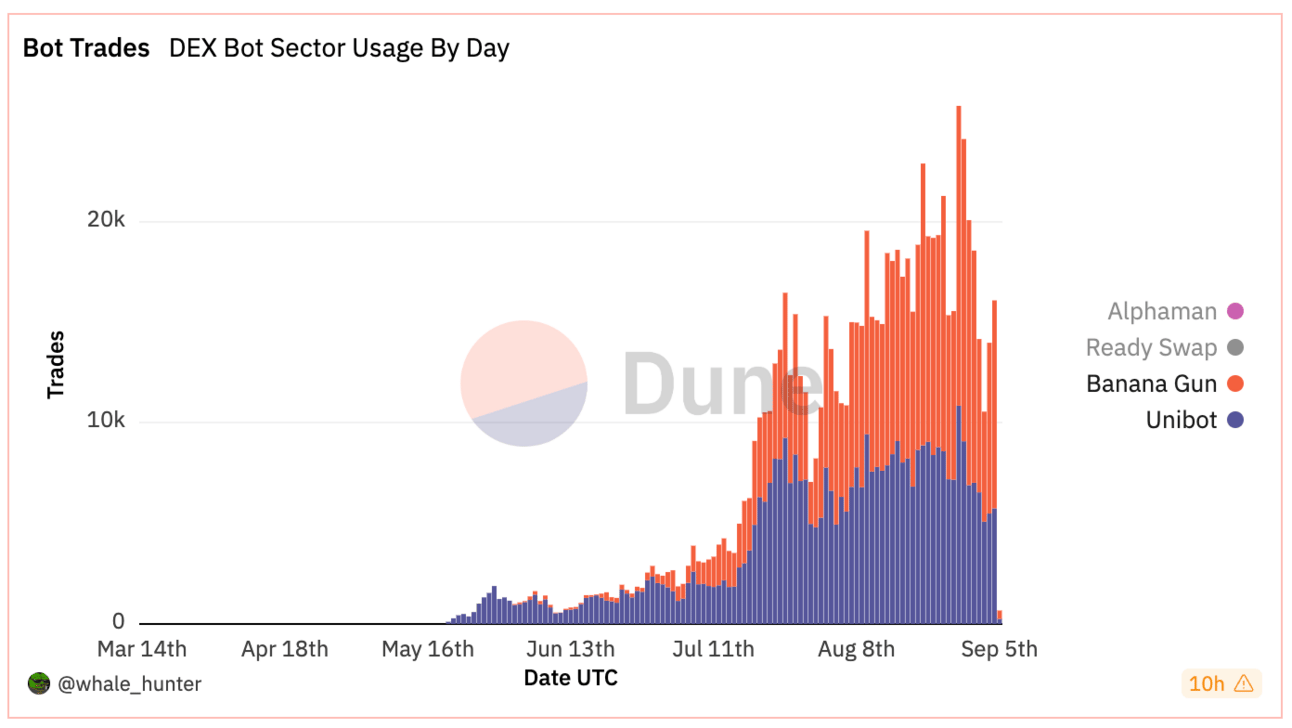

Unibot disrupted Maestro dominance by launching a token, which is responsible for more than 2/3rd of all the revenue it has earned so far. Banana gun bot seemingly has managed to carve out a niche for itself, possibly due to superior bribe UX, and has now announced a token. Here is where we are if we looked at both PvP.

Current Situation

Daily Users $Banana > $UNIBOT : 17th August was the first day that Banana gun bot had more users than UNIBOT. While the gap was minimal at first, it seems to be widening, with many users likely to be airdrop farming too!

Daily Bot Volume $UNIBOT > $Banana: While Banana has posted very respectable numbers throughout, UNIBOT has had the edge on volume on all but 1 day. This is very likely to change in the run up to the airdrop, as users try to get the SBT that would make them eligible for the airdrop. More importantly, the volume will only increase post the launch of a token. $UNIBOT’s top trading pair by volume is of course, its own token, with $34m+ in volume traded through the bot.

Daily Number of Trades $Banana > $UNIBOT: Since speculation, and now confirmation of the token, users are ramping up their volumes to become eligible for the airdrop.

The Beef 🥩

Clearly, $UNIBOT team is not happy about a bunch of things. Some of it is legitimate and some of it is pure pot calling kettle black.

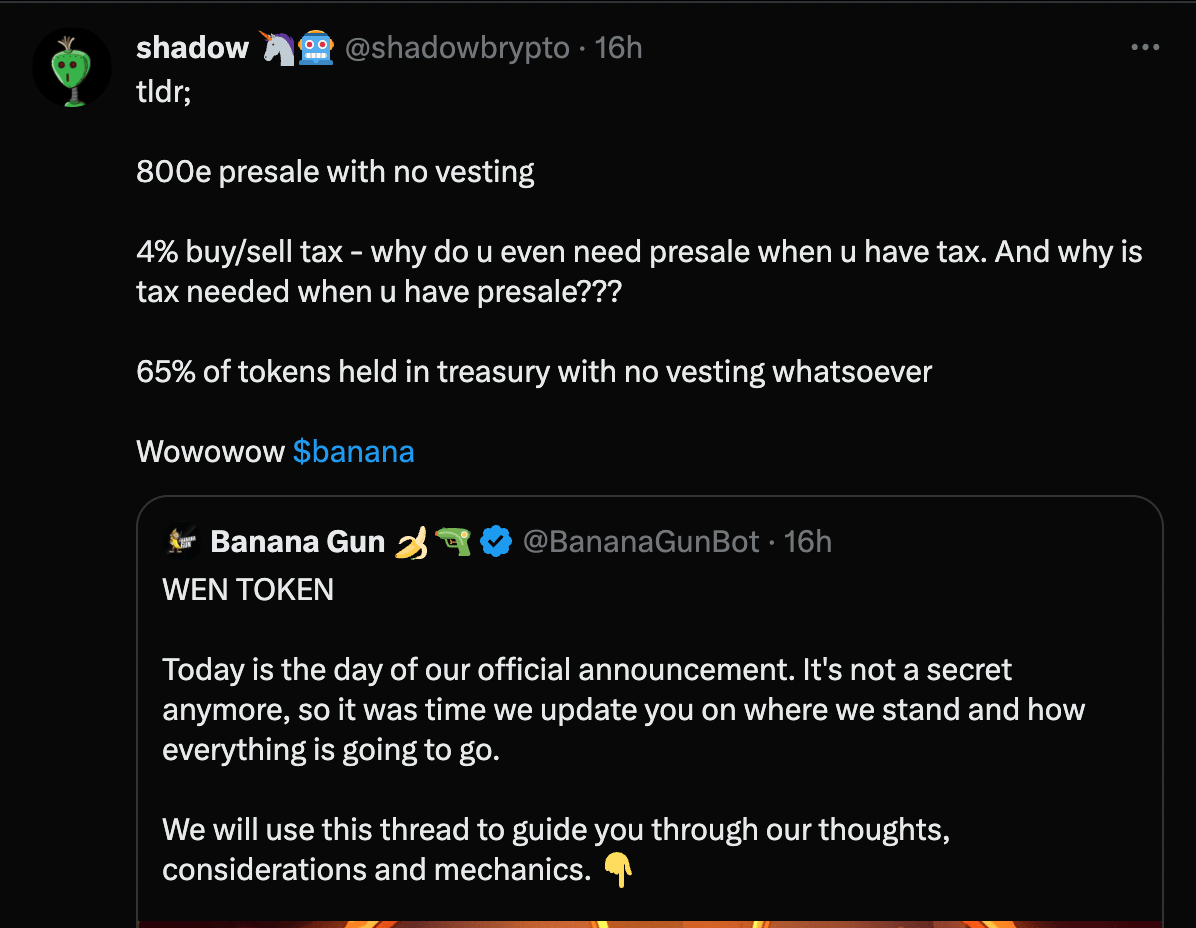

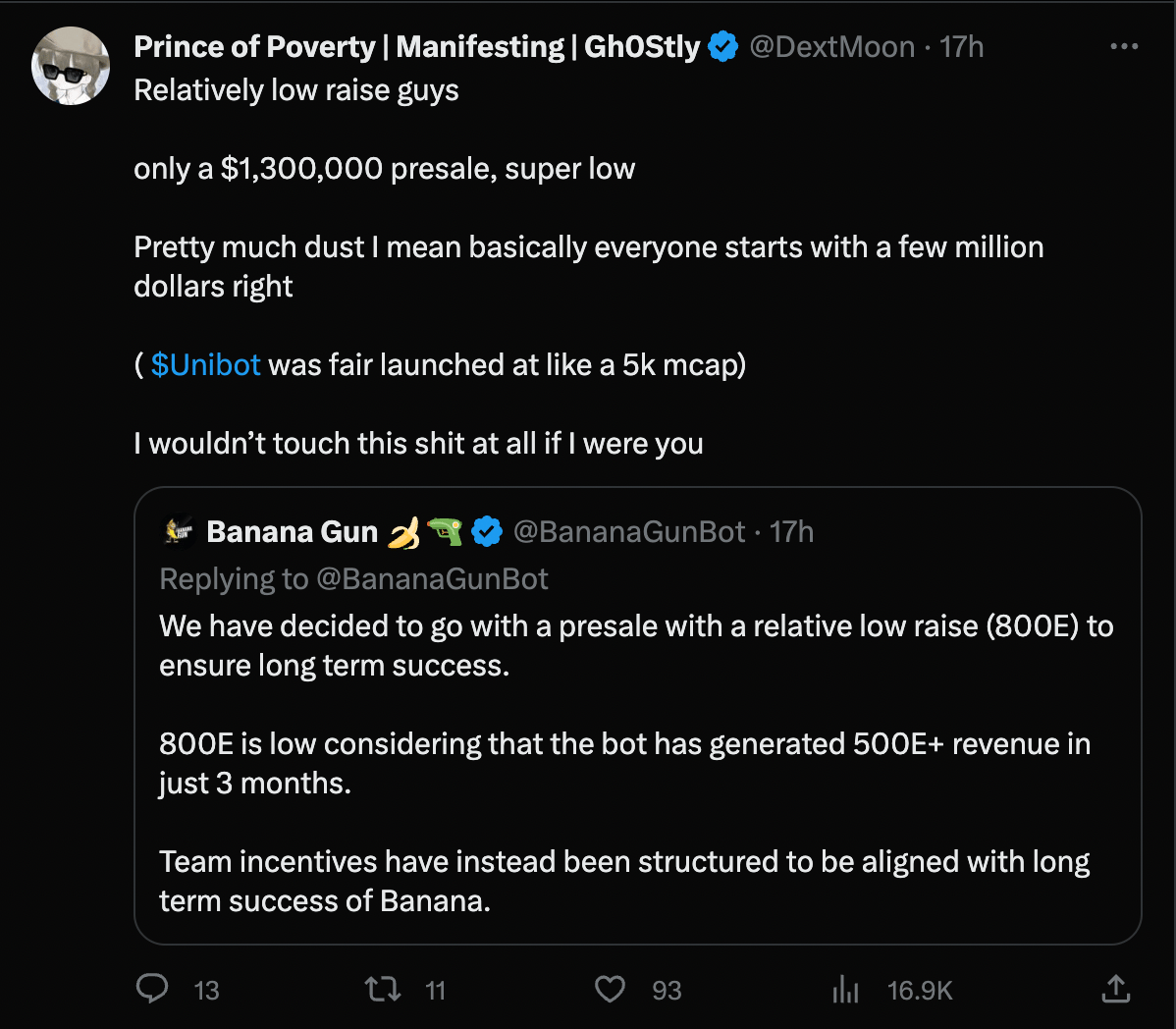

Pre-sale + 4% Tax - BULLSHIT CLAIM: The $Banana team is raising a mammoth 800E over the weekend as a pre-sale, along with launching with a 4% token tax. To give you context, $UNIBOT has made most of its money (6300ETH!!) from a 5% tax on every buy and sell. Seems like from this tweet, someone from the $UNIBOT team is faulting $Banana for taking a presale and having a 4% tax. I would have had some sympathy if they did not have a 5% tax on a >$100m mcap token that has more than 7800 ETH in fees. You cant make 6300 ETH because of a tax and tell someone not to have a tax because they raised 800 ETH.

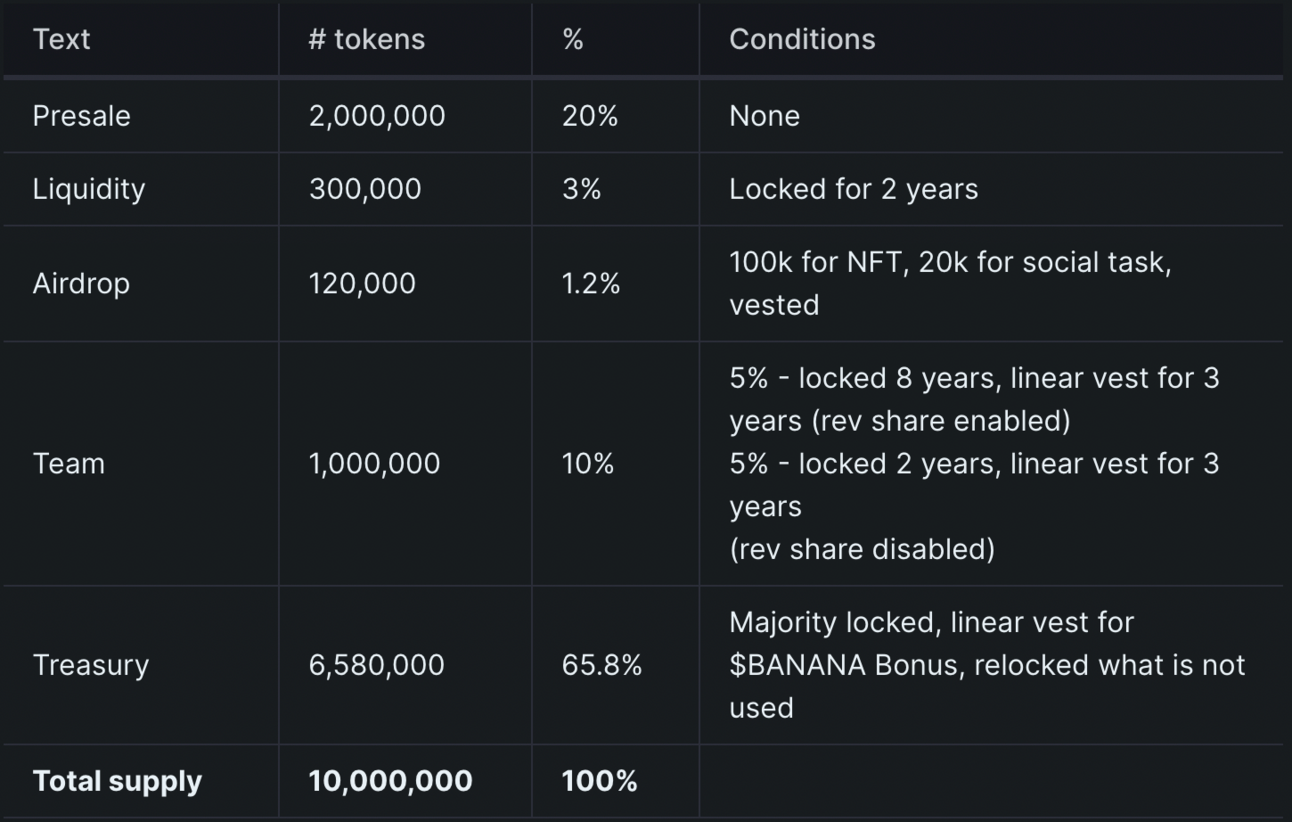

65% of Tokens Held in treasury - LEGIT CLAIM: This is tricky because it puts an inflationary pressure on token and the token price. Also, for a project that is not an L1/L2, why do you need 65% of your tokens as rewards? Not sure if the team could control this at will. If so, that is very dangerous.

$UNIBOT was fair launched at $5k mcap - POOR COMPARISON: While this may be true, you cannot really use this to legitimately compare. $Banana seems to have the better sniper product which has allowed them to do 500E+ in revenue. Cannot really launch a token at $5k mcap if you are doing 10E per day in rev, can you?

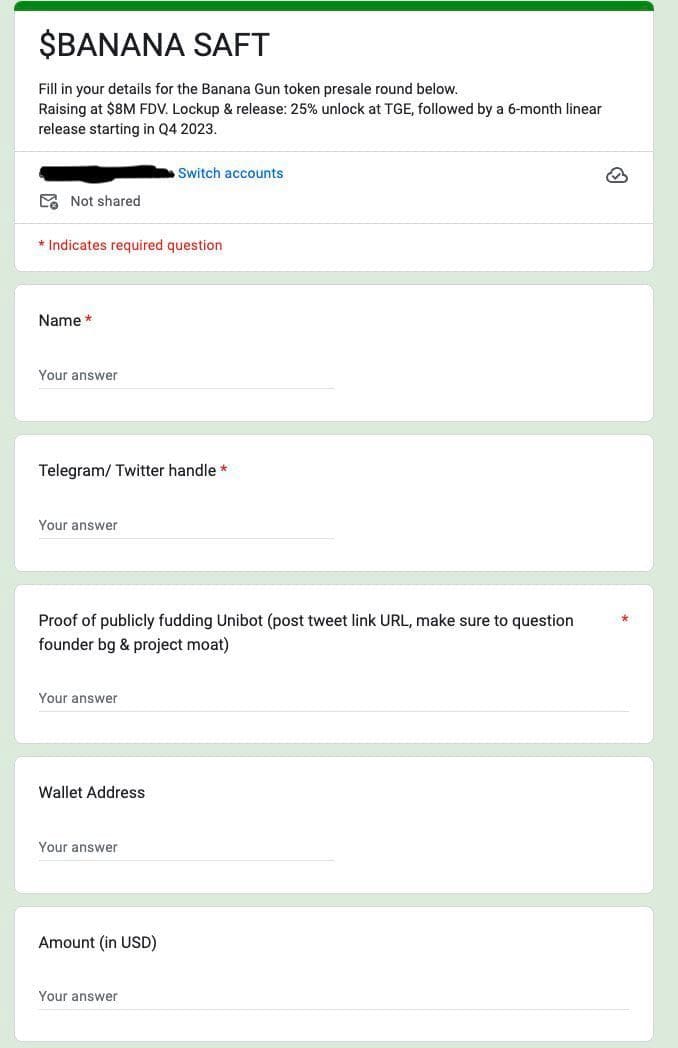

P.S. Not sure if this is real, but if it is, has to be a first. “Proof of Publicly fudding Unibot” KEK

$BANANA TOKEN

Raise

Raise: 800E

Max allocation: 1E

Presale price: $0.65

Launch price: $0.65

Starting market cap: $1.56m

Starting FDV: $6.5m

Tokenomics

Circulating supply of 2.4m tokens (including liquidity). The token will have a 4% buy and a 4% sell tax, which will be streamed towards:

2% - token holders

1% - team

1% - treasury

This tax will be lowered later on, when market cap has grown substantially.

Initial liquidity will be seeded with 300k $BANANA and $195k liquidity for a total liquidity of $390k for a $1.56m starting market cap. Therefore starting price will be $0.65 equal to presale price.

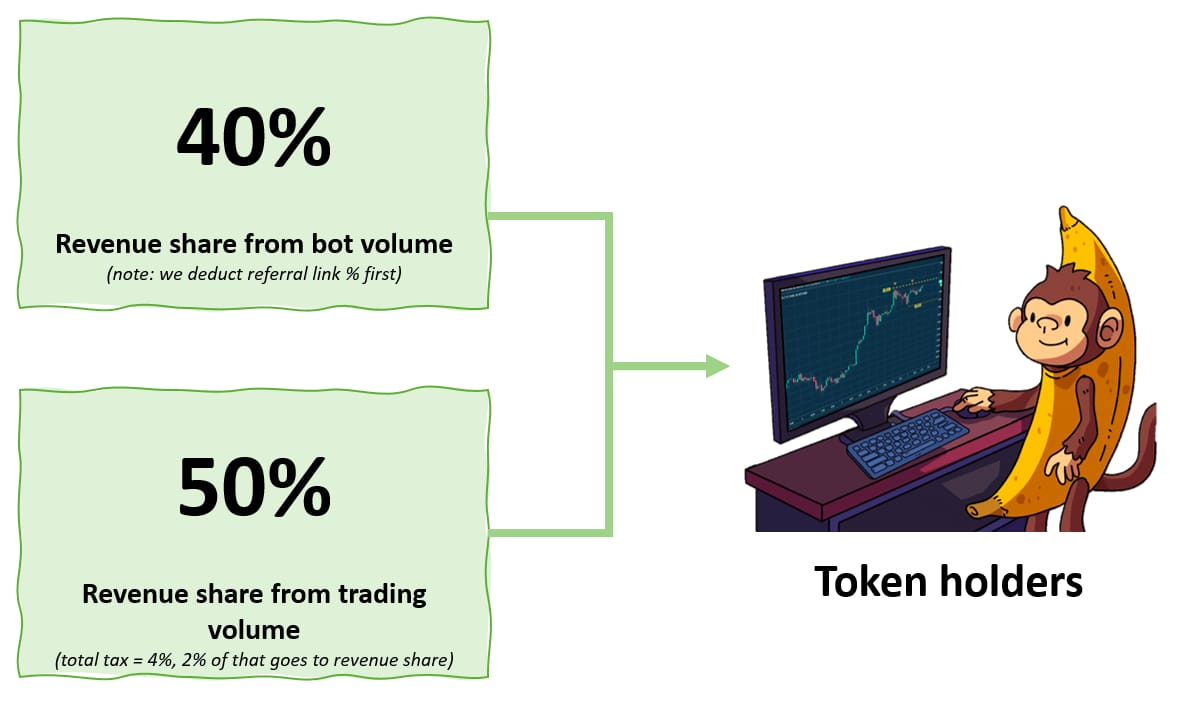

Revenue Share

Fees and Utility

Manual buying = 0.5%

Autosniper = 1%

Incentivize trading through Banana Gun with a cashback in $BANANA following the formula:

$BANANA cashback = FEES PAID ($) * multiplier X

Multiplier X = adjustable multiplier between 0.05 and 1 which can be adjusted to carefully manage emissions (or to grant a "happy hour"!)

Conclusion on Token Econ

I think the token econ is interesting, but given it is inflationary in nature, there is a huge reliance on this adding a lot of users/token speculators/volume. We are barely 3 months into the $UNIBOT story and have seen a 50%+ correction on its ATH.

If you think $UNIBOT does not directly respond to gate its market share, with its substantially larger treasury (they have done almost 8k ETH in Fees), you are naive.

66% for treasury is strange. It is a really large number. You see this type of allocation for L1/L2’s looking to bootstrap application activity on their chains. For an application itself with such a specific market/niche, how do they plan on emitting/rewarding users with $5m worth of tokens??

💹 Price Predictions

There is clear euphoria around this launch, and I would be very very surprised if this token does not do really really well in its first month. I expect volume to cool off slightly post airdrop/launch, just because it is obvious that folks are farming aggressively atm. Here is what I think happens, at a bare minimum. I almost did a sensitivity analysis before I realised that crypto does its own thing for the most part. So all of this could be completely useless!

Assumptions

Emissions will play a huge role in the way this plays out. I have assumed 25% and extrapolated the fees to date to annualize them (this likely will not play out, but serves as a heuristic.

P/E multiple will be the same for $UNIBOT and $BANANA (perhaps the most unlikely. It will be more in the beginning and less if competitive dynamics change)

The bot continues makes on average, the same that it makes today, not less

$BANANA-WETH becomes the top pair for Bananagun Bot Users:

Given that $UNIBOT-WETH has done $34m in volume since launch, generating $340k + in bot fees + $1.5m+ in token taxes, we should expect a similar outcome for $BANANA.

Case 1: Volume 50% of $UNIBOT-WETH

Bot Fees: 0.5%= $17m x 0.5% = $85,000 (52ETH)

Token Tax: 4% x $17m = $680,000

Rev Share= 40% of Bot fees + 50% of Token Tax = $378,000

Estimated total additional revenue in 6-8 weeks post launch = $765,000 (450+ETH)

Launch Price= $0.65

Estimated EPS= Current Bot Revenue + Projected Additional revenue/No of Tokens (*95/365)

Emissions (Assuming 25%)= 750,000

Adjusted EPS= $1.335

Price Target 1= P/E Multiple of $UNIBOT x Annualized EPS =

$2.91 (4.47x from launch price)

Case 2: Volume 25% of $UNIBOT-WETH

Bot Fees: 0.5%= $8.5m x 0.5% = $42,500 (27ETH)

Token Tax: 4% x $8.5m = $340,000

Rev Share= 40% of Bot fees + 50% of Token Tax = $187,000

Estimated total additional revenue in 6-8 weeks post launch = $382,500 (230+ETH)

Launch Price= $0.65

Estimated EPS= Current Bot Revenue + Projected Additional revenue/No of Tokens (*95/365)

Emissions= 750,000

EPS= $1.052

Price Target 1= P/E Multiple of $UNIBOT x Annualized EPS =

$2.295 (3.4x from launch price)

Parting Thoughts

The competitive dynamics of the TG bot operators is heating up. While it seems like these players are here to stay, sillier things have happened in crypto. Fully expect large moves from Maestro and $UNIBOT to defend their market dominance. Seeing the pettiness from the $UNIBOT team left a bit of a sour taste. The existence or failure of these TG bots have no meaningful impact to broader crypto atm. They exist to serve degens.

If you are a shitcoin trader using TG bots, you should demand lower fees instead of letting them charge higher fees. Show this by flocking to the bot which offers cheaper fees. Also, these guys now all have millions of dollars but have not figured out self custody. DEMAND MORE!

“Not your Keys, Not your Crypto”.