- Abstract(ed)

- Posts

- Farming Alpha #0001

Farming Alpha #0001

Real World Assets are Coming

Deep Dive Thesis 1: RWA is Coming!

This edition of Farming Alpha is Sponsored by QuantCheck Labs, a research institution that designs proprietary trading models to give cryptocurrency traders an edge! Discover how you can get ahead of the bulk of traders here!

GM/GE/GN to my indefatigable crypto savants! I put out this tweet a couple of months ago and thought that its maybe a good time to elaborate further on why I have this seemingly grandiose sentiment.

A large criticism of DEFI is that most yield is manufactured from MIM (Magic Internet Money). And it is true, historically. Remember how Wonderland became Neverland last year? But this time feels different, and it is. Tokenisation of Real World Assets (was the most boring thing you could say to retail last year) is one of the reasons why the next DEFI Summer is going to be the best one yet!

This deep-dive is designed to help you create a mental map of everything RWA, from how it works, to how we think it will unfold. For those of you that are short on time, here is a shortlist of all of the listed tokens mentioned in the article.

(P.S. I have not mentioned Tron as I do not believe it to be a good faith actor in the space)

Make sure to follow me on twitter for more on-chain ALPHA.

For those of you that have some time on your hands, let’s jump straight into the long form! PS- most of my research was made very convenient thanks to Jack Chong and the Rwa.xyz team’s report. I aim to summarise the key insights and augment a few of them.

What is RWA

RWA (short for Real World Assets) refers to the idea of representing, tracking and making Real World Assets available to on-chain participants. The two key points to note here are that the underlying real world assets are represented (tracking their value) AND these instruments confer some level of ownership to the underlying asset, which is enforceable by law.

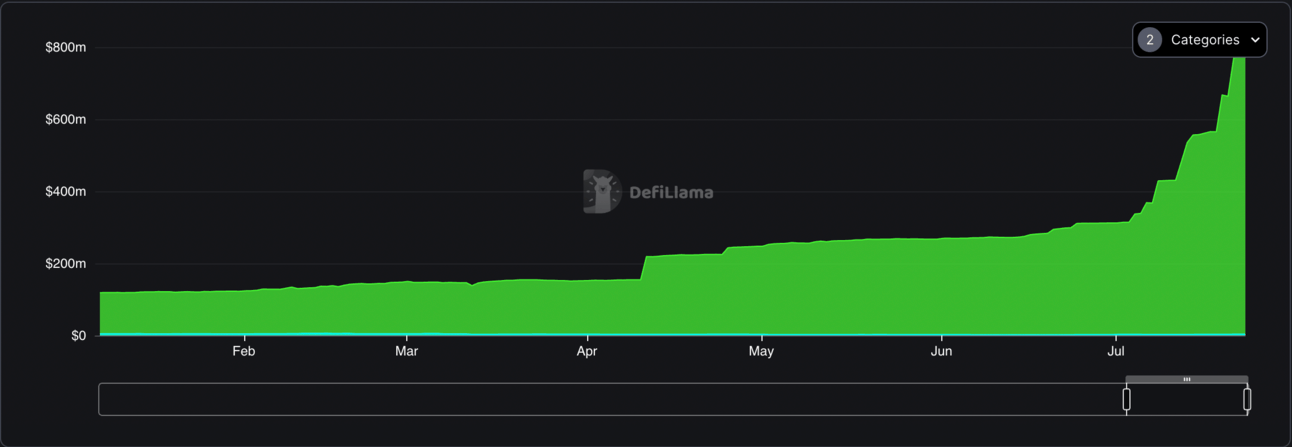

Presently, the total TVL of RWA is about $800mn. It also stands out as one of the few areas of DEFI that has seen consistent growth while everything else is stagnant.

There are 3 principal types of RWA.

On-Chain Opportunities

Today, we have many on-chain entities generating revenue. These Revenue streams present unique financial opportunities that are akin to Revenue Backed Financing (RBF) in the real world. Such on-chain opportunities exist only due to blockchains. Without the existence of blockchains, there would be no potential to lend to DAO’s/protocols against their on-chain revenue.

Arbor Finance issuance of Fixed Yield Bonds against Ribbon Finance Treasury is one such example. DebtDao is another marketplaces for DAO’s to borrow against their revenue, likely to be quite popular for fee generating protocols.

Another good example is Hashpower backed loans by Icebreaker Finance.

On-Chain Opportunities, Off Chain Capital

We know that blockchains have certain revenue streams that are unique to them. Our expectation is that off-chain capital is going to look for exposure to some of this crypto-native revenue, without necessarily becoming an on-chain participant.

An example of this would be a fund created to become a validator node on ETH, pooling capital from various investors as LP’s in a fund.

Tokenising Off Chain Opportunities

Bringing off chain yield like USTreasuries, Commercial Real Estate Yield, Private Credit, etc etc on chain. The goal is to provide on-chain participants with non correlated yield to diversify exposure from crypto.

How to Bring Off-chain Assets on Chain??

Which Token Standard??

If I had a penny for every time I heard someone say the word “Tokenise”, I would have a decent amount of $DAI. To put it plainly, tokenisation refers to the act of bringing a particular off-chain asset on chain i.e Representing it and conferring the subsequent ownership within a said instrument (token).

Depending on the nature of the RWA being tokenised, we should see structures and standards that involve ERC-20’s and ERC-721’s, which make them highly composable with DEFI.

However, I suspect that there will also be ERC’s that will be specifically applicable to RWA. I suggest reading more in detail about that here.

Infrastructural Requirements

Oracles

If you want to trustlessly access DEFI rails to bring Real World Assets on chain, their data needs to also be made trustlessly available to on-chain participants. Oracles become increasingly important, particularly those that are Privacy preserving. Accessing Mortgage information, Bank Account Numbers etc, must be done with Privacy preservation in mind. Chainlink’s DECO will likely play an integral role in enabling this.

KYC + Credit Scores

Real World Assets usually have KYC requirements. On-chain equivalents of this need to be built so as to make it less cumbersome to access different RWA on-chain. The job to be done here is to ensure Decentralised ID, issue them and make sure that there is sufficient interoperability for these standards.

Initiatives such as Quadrata aim to issue a Passport Soulbound NFT that ensures compatibility with all 500 of their onboarded partners.

Stablecoins

Maker DAO, the issuer of $DAI seems to be primed to grow their balance sheet of RWA’s even further, cementing their position as one of the key components of liquidity and infrastructure in RWA.

Greater than 10% of their protocol revenue comes from RWA’s.

(Predictions come after the Sponsor Corner)

SPONSOR’s CORNER

If you have been through crypto cycles, you know that a 2x is just as possible as getting rekt. A lot of us trade large MC crypto’s, with leverage, without a good enough understanding of who we are up against. Meanwhile, larger, institutional traders are using sophisticated models to extract as much alpha while minimising risk. Unless you have >$500,00 and are an accredited investor, it is unlikely that you are getting exposure to these models any time soon.

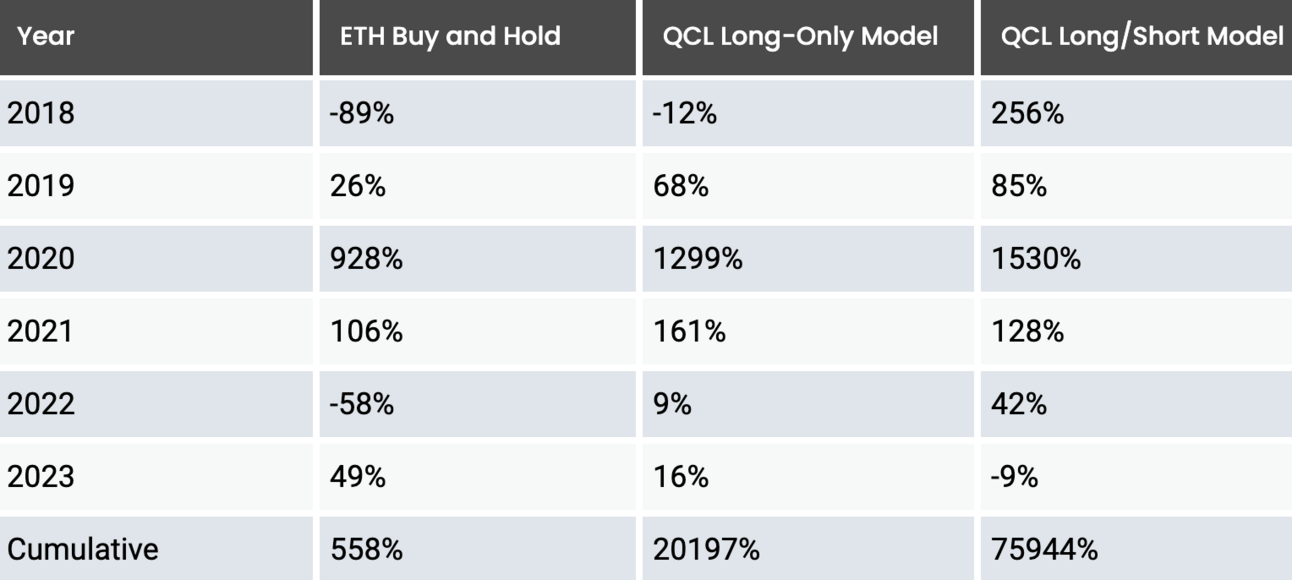

While most models are black box, secretive and hard to access, there are some models that work better when more people use it. One such model is a trend model! Quantcheck Labs has built a high-medium timeframe model (LongShort ETH/USDT).

The returns are ASTOUNDING, especially since they exclude leverage. What’s even better- QCL is easy to access! (Instructions below)

How does it Work?

Email Notifications for New Buy/Sell Signals. You get to choose if you wish to sell or short when a bear signal appears. Easy to set up trades from the email instructions on your favourite CEX/DEX.

Subscription based tool @$150 per month. In case you think it is a lot, $1000 invested with QCL’s model in 2018 would be worth $759,440. (5 years subscription cost= $9,000. Net profit= $750,440)

A track-record of successful trades as evidenced in backtested data. 56.67% of Trades were profitable, with the average ROI on successful trades at 55.05% and 6.88% on losing trades.

If you like what you’ve read so far about QCL, head over to their website and read more about what they do.

Make sure to use my referral code “HROJANTORSE” to get 5% off for the first 6 months!

QCL is a research institution. None of their offerings are financial advice. Please make sure to always do your own research!

Predictions

Real World Assets will experience true parabolic growth when Tradfi Cost of Capital > Defi Cost of Capital + Cost of Compliance

When this happens, I suspect Defi would have eaten Tradfi. While I view the recent surge in interest as an inflection point, my forecast for how the RWA Narrative plays out is likely to hold true to this equation.

1. DAO demand for Deep Liquidity RWA > Tradfi demand for Tokenization

At this point, DAO treasuries are sitting on $$$, all in crypto, all highly correlated to each other. The DAO’s of DEX’s, L1’s, L2’s, LSD’s and other high fee generating protocols will be keen to move some of their treasury into USTreasuries, Money Market Funds and more.

I anticipate issuers of these Deep Liquidity RWA’s to win big.

Shortlist

TProtocol (Airdrop for LP announced)

2. Defi will buy what Tradfi will not

This one hits a little close to home. I founded a reasonably successful micro lending firm in India between 2020-Jan 22. We partnered with companies to give their employees access to loans against their salary. What came out of it was a pretty sticky, recurring product, often preferred to credit cards by most employees. We were pretty useful too, helping people out with an instant line of cash in some very real emergency situations. When I showed my loan book to my lending partner, I was hoping that they would be willing to give me a line of credit. I was, quite literally, lending out of my own pocket. My CFO, a seasoned investment banker, had these amazing plans to securitise our loan book too. 2 things happened instead:

I was asked to provide a security deposit, which was more or less overcollateralized

The line of credit offered to me was at 24%

I was laughed at for suggesting some kind of securitization

Given that a lot of our loans were to employees who had lower credit scores, no financial institution wanted to take any kind of risk. At 24%, the cost at which the end user would have to borrow for me to make any kind of money was north of 55%. A default rate of 3% would have been enough to result in a loss.

Someone like me would have jumped at the opportunity to access DEFI Liquidity at even 18%. And I suspect that all RWA Lending is likely to happen in emerging, under-served markets. The RWA.xyz team describe this as the “Long-tail”. I recently spoke to the founder of Jia Finance, who is working really hard to make sure MSME’s in Indonesia have access to credit at affordable rates, by accessing DEFI liquidity. Goldfinch started this trend and I expect to see many more protocols that find a pocket of an emerging market fund/fintech and enable loans on chain.

It is likely that retail users, DAO’s and crypto funds, especially in the beginning, will get a huge incentive to participate in this ecosystem. This would likely be a combination of the protocols guaranteeing zero downside AND issuing a high APY through their Governance tokens.

You might have a situation where you provided $1,000 in liquidity to one of these lending protocols that give you 10% in stables and another 30% in their native token. If the narrative is cooking, those native tokens could reach silly ATH’s.

Shortlist

3. Alternative Asset Tokens Could pump if the Narrative takes off

Things like private equity and real estate tokenisation hold tremendous promise but are simultaneously plagued with illiquidity and regulatory arbitrage. While I believe it is worthwhile tracking these protocols, I do not expect them to generate sufficient fees to be able to moon. However, there are some interesting early concepts like prediction markets for global real estate and on-chain Private Equity which should be looked into!

Shortlist

4. L1/L2’s likely to see a surge in RWA driven demand

Stellar:

Franklin Templeton issued its first set of money market funds on the Stellar blockchain (Non EVM), which marks an interesting relationship between Tradfi and Defi. If they continue to tokenise more of their assets on Stellar, there could be a surge in demand for the chain.

Given that Franklin Templeton has already begun asset issuance on Polygon, I see it as a better pick.

Polygon:

Polygon is home to Tangible protocol and Ondo. This, coupled with being a ZKEVM leads me to believe that it might find itself in great position to capitalise on RWA Summer.

Of course, we will see protocols attract high TVL across different L1’s and L2’s. However, I do not believe that their price action will be catalysed by RWA.

Parting Thoughts

Crypto engulfing Tradfi has never been as much of an inevitability as it is today. We are well and truly at an inflection point which feels like its been forever in the making. The zero interest rate days are behind us. The failure of Tradfi, banks, currencies and economic policy has been completely exposed. In case I sound like I am gloating, I am!

See you next week :)